Apparently, the last thing to do before climbing a ladder is to shake it to make sure it is stable.

The same applies to the economic situation: one should check if the situation at the time of applying (signing the funding agreement) is stable enough that the additional burden of the EU project will not topple the ladder, meaning the enterprise.

And in the attached photo, I am checking if the rope is stable 🙂

The topic is complicated, so… we will explain it in three points.

- Firstly, public aid cannot be granted to an entrepreneur in a difficult situation (according to Article 2(18) of the EU Regulation No. 651/2014).

- Secondly, if you are an SME that has existed for less than three years – TSE does not apply to you.

- Thirdly, TSE occurs when at least one of the following situations arises:

- More than half of the share capital has been lost due to accumulated losses. This situation occurs when the accumulated loss exceeds the value of the reserve capital (and all other capital considered part of the company’s equity) and half of the share capital value.

- (For large enterprises) in the last two years:

- The company’s debt-to-equity ratio exceeds 7.5; and

- The company’s interest coverage ratio to EBITDA is below 1.0.

- The company is subject to collective insolvency proceedings or meets the criteria under applicable national law to be placed under collective insolvency proceedings at the request of its creditors.

- The company has received rescue aid and has not yet repaid the loan or terminated the guarantee agreement, or has received restructuring aid and is still under a restructuring plan.

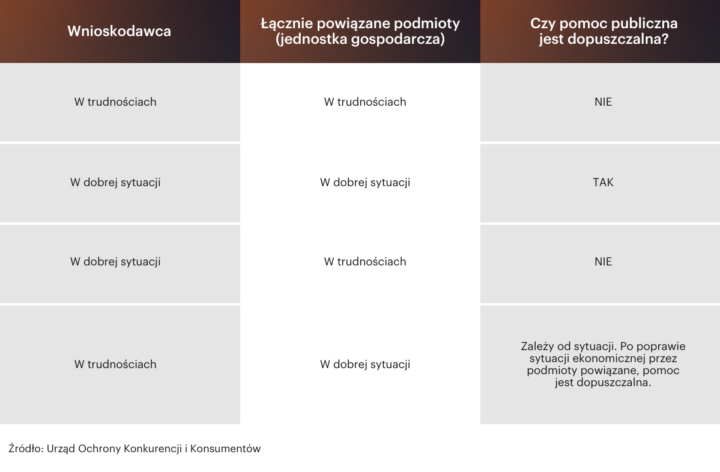

The immediate question arises: does the overall situation of other related entities affect the TSE status of the applicant?

Of course.

And here is a cheat sheet: